What Is a DBA (Doing Business As) and What It Means for Your Business?

Learn how to get a legal DBA name.

February 7, 2025

February 7, 2025 8 minute reading

8 minute reading

A DBA (Doing Business As) allows business owners to create a trading name separate from their legal business name.

Filing for a DBA is necessary when you want to operate under a more creative name that better reflects your services. The process involves preparing a document and obtaining approval from a Public Notary. While the procedure requires effort, using a different name that truly represents the business can provide significant benefits.

This guide will help business owners understand when their enterprise needs a DBA, how to set one up, and what to consider after obtaining one. Through practical examples and insights, the guide explores the ins and outs of DBAs, helping navigate this important aspect of business branding and operations.

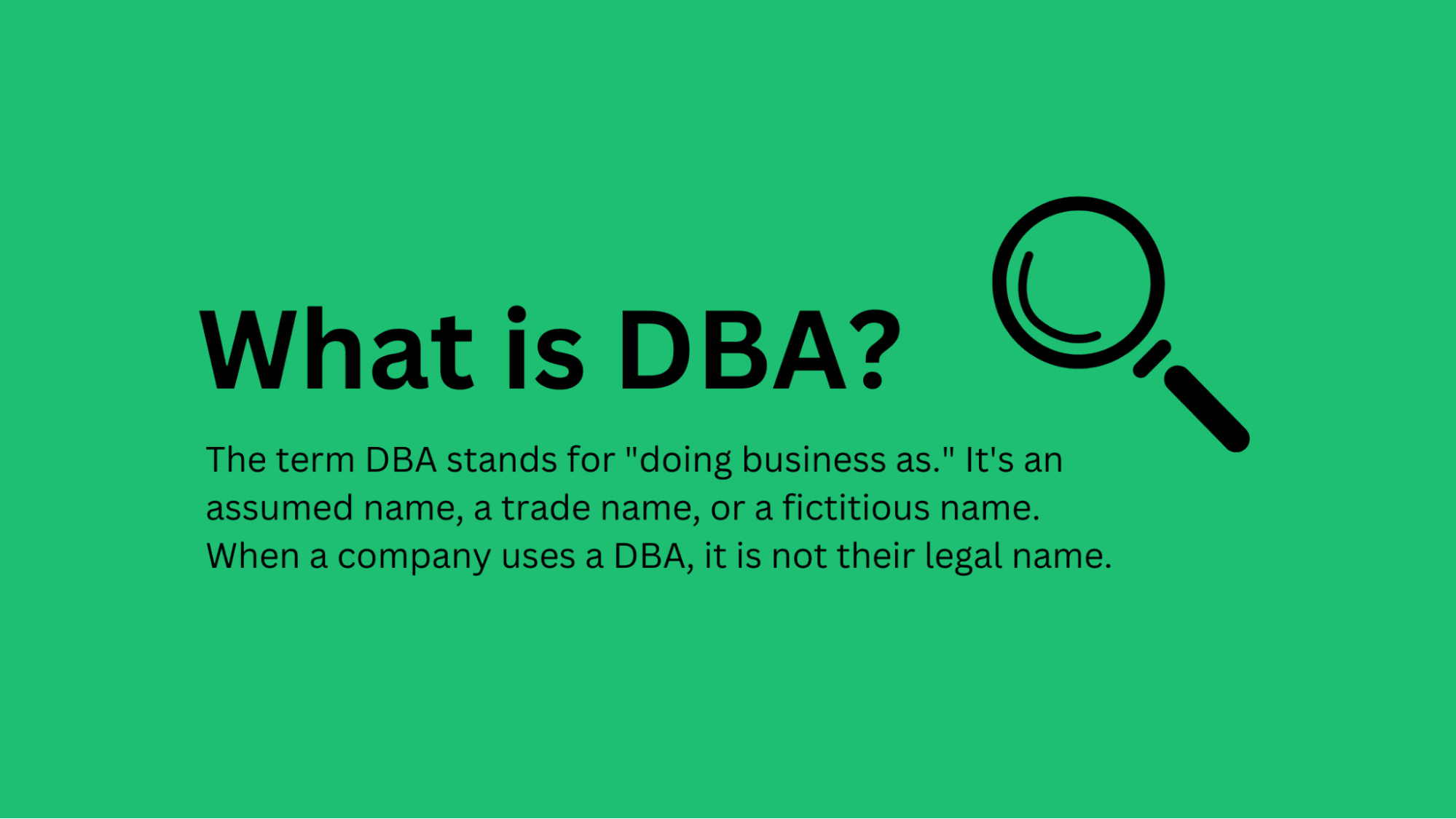

What DBA means

DBA stands for "doing business as." Also referred to as an assumed name, trade name, or fictitious name, a DBA is a separate registered name businesses use more for branding and isn't the same as their company's legal name, which is usually what appears on their business license and tax returns.

Instead of operating publicly as "Jade Smith," the owner could operate legally under "Jade's Candles Inc." Jade could also set up a DBA if she got married and changed her name, but had built her business under her maiden name, so she could still do business under "Jade Smith."

Can a business have multiple DBAs?

Yes, a business can have multiple DBAs. Companies that operate different businesses under the same corporate umbrella often market services and products under separate names.

A company named Silverpeak Capital LLC, for example, could obtain multiple DBAs like Silverpeak Real Estate and Silverpeak Wealth Management. This lets the LLC operate as two different businesses without setting up a separate entity for each.

Some advantages of having multiple DBAs include:

More effective marketing. A simple and catchy DBA can attract your target market.

Cross-state compliance. Rather than setting up a new LLC, you can register DBAs in states you plan to do business in.

Easier to relaunch. You can rename and relaunch a new business under an existing registered business.

What a DBA is not

A DBA is an assumed business name, but there are certain things it does not provide for your business.

There is no separate legal entity for a DBA, it's just a name used by an existing business. The legal structure and liability of the business remain the same regardless of how many DBAs it registers.

Using a DBA doesn't provide limited liability protection. The underlying business structure, such as a limited liability company or corporation, decides liability protection. Sole proprietors and partnerships using a DBA are still liable for their personal assets.

DBAs also do not

Offer any tax benefits

Provide any trademark protection or intellectual property rights

Provide a corporate status

For example, if "John Smith" operates a freelance writing business under the name "Elite Writing Services" as a DBA, this name doesn't create a new business entity, nor does it provide legal protection or limited liability. It's just a way for John to run his online business under a different name.

💡 Need help setting up your entity? Get a business structure consultation from a certified professional on Fiverr.

Find a Professional Business Structure Consultant for Hire

Who needs a DBA?

Shopify Burst

When you first started your business, you had to decide on the best legal structure—maybe you went with a sole proprietorship, partnership, or LLC.

Now, you want to jazz things up with a catchier, more customer-friendly name that’s different from your legal business name. A DBA is a great idea. However, your type of business and legal structure influences your need for a DBA.

Here’s what you need to consider.

Sole proprietorships and general partnerships

Your legal name is Winnie McBeth, and you start a freelance design business as a sole proprietor. The name of your business would be your own name, Winnie McBeth.

If you want to operate under the company name, "Winnie's Design," you'll need to file a DBA with your state. This is because sole proprietorships are unincorporated, and aren't required to file business formation papers or an official name with the state.

The same goes for general partnerships. Note that even if you didn’t take any formal steps to declare your small business as a sole proprietorship or general partnership, you still have to adhere to federal tax rules that apply. Find tax setup and EIN application services if your business isn’t ready to sell yet.

Franchises

Often, franchise owners buy a franchise business under their own limited liability company (LLC) or corporation and then get a DBA to operate under the commonly known brand name.

If you bought an Arby's franchise through your business, Burgers & More LLC, you could get a DBA to operate as "Arby's” in your city. This would let your state know exactly who you are and under what name you're doing business.

Corporations, LLCs, and LLPs

In many cases, LLCs, corporations, and LLPs don't require DBAs, because the business name was likely already registered with the state. Keep in mind that this varies by state, city, and county, so check your local guidelines.

Still, some businesses can register a DBA to operate under a name other than the one on their incorporation documents. This may happen when the business wants to introduce a new line of products or services, but it can also happen during rebranding.

Operating under a unique trade name through a DBA allows some separation while still keeping the companies connected through a single business license. Your business structure and state guidelines may allow for this or may not, but sometimes, this is an easy option to expand with less hassle.

💡THE GOLDEN RULE: If you're established under one name and want to operate under another, you'll need a DBA.

Why use a DBA name?

There are many advantages to using a "Doing Business As" (DBA) name for business operations, like more flexibility and branding. With a DBA, businesses can run under a trading name without having to get a new license or re-register an existing one.

With this flexibility, businesses can launch new products or expand to new areas under new names, and use more creative or marketable brand names than their legal business names.

If you’re a sole proprietor, it’s easy to use a business name without incorporating your business. It’s also easier to open a business bank account or credit card and operate legally within your state.

DBAs can also help business owners stay private and secure, especially sole proprietors who otherwise operate under their legal names. Using a DBA that doesn't include the owner's full legal name can make it more difficult for the public to access personal information, providing an extra layer of privacy and security.

How to file a DBA (and the costs)

Shopify Burst

DBA registration involves filing forms with either the county clerk, the secretary of state, or a state’s business registrant. It typically costs between $10 and $100, and it’s a relatively quick process. In many cases, you may hear back within a month.

While the process varies from state to state, this is the general process that many states follow:

Check the state’s database to ensure that your desired DBA isn’t currently in use by anyone else. If so, you’ll need to choose another name.

Download and complete the DBA submission paperwork. This often asks about your legal business name, location of operation, business owner name, desired trade name, and tax identifier.

Submit the application online or via mail (whichever is required) to the address specified online, along with the filing fee.

💡TIP: Make sure you read your state's guidelines for your specific business structure. Filing requirements may differ depending on the jurisdiction.

In California, for example, you need to file your DBA with a county and then publish notice of it in a local newspaper within 30 days.

Find a Professional Legal Consultant for Hire

In New York:

Sole proprietorships must file a business certificate with their trade names through the county clerk’s offices.

Corporations, LLCs, and limited liability partnerships (LLPs) must register their trade names with the New York Department of State.

Other states don't have any requirements for businesses to register trade names. If you're unsure of how to do that, you can talk to your state's business department, a lawyer, or a trusted DBA filing service.

Choosing your DBA name

Since you’re spending time and money on creating a DBA, choose the right one from the start. You can always change it later, but you’ll have to pay again.

Understand your purpose behind wanting a DBA. Do you want more privacy? Or a more creative business image?

If, for example, you simply want a catchier name than “Jane Smith LLC,” but you still want the name recognition, you can opt for “Jane Smith Graphic Design.”

If you like the idea of keeping some aspect of your name in the DBA but want it to sound more “elevated” and less like a sole proprietorship, you can opt for something like “JS Designs & Graphics.”

Come up with a few ideas, or use a business name generator to create a list of catchy options.

💡TIP: Secure your company’s DBA and apply for a trademark. Trademark protection ensures your company DBA remains unique and that your customers always know who you are.

What to consider after getting a DBA

After you’ve set up your DBA, keep it in good shape.

Here’s how:

Notify your tax authority. Your local or state tax authority may need to know about your DBA, especially if you're collecting sales tax.

Update your contracts. Update any existing contracts, agreements, and business documents to include your DBA.

Know your renewal dates. To avoid your DBA's expiring, keep track of when you need to renew it. Some DBAs last between 3 and 10 years, while others never expire.

File a DBA in every state you do business. A DBA in one state does not apply to other states.

Hire legal services to help on Fiverr

Don't let the complexities of choosing and registering a DBA name slow down your business momentum. While the process can be straightforward, getting it right is essential.

Consider consulting with legal experts on Fiverr to help you select the perfect DBA name and navigate the application process. Their experience can save you time, ensure compliance and ongoing requirements, and help you avoid costly mistakes. With professional assistance, you can confidently establish your DBA and focus on growing your business.

What is a DBA FAQ

Does a DBA hide your name?

A DBA doesn't hide your identity. It allows you to use a different business name without creating a new legal entity. However, registering a DBA typically requires that the true ownership be disclosed.

What are the disadvantages of a DBA?

There are no tax benefits

There is no liability protection

There are no exclusive rights to your business name

There is ongoing maintenance

What is the difference between a DBA and an LLC?

A limited liability company (LLC) lets you run your business as your own legal entity and protects you from business debts and lawsuits. A DBA lets you operate under a different name without forming a separate legal entity. Setting up a DBA is quick and cheap, but forming an LLC can be complicated, requiring professional help and re-registration every year.

What are examples of a DBA?

Examples of a DBA include a sole proprietor running a freelance graphic design business under the name “Creative Design Studio”, rather than their personal name. Another example could be a tech repair LLC running under the name “Quick Fix Electronics,” rather than the entity's legal name, Mighty Tech Repairs LLC.

Is DBA the same as an assumed name?

Yes, a DBA is essentially the same as an assumed name, a fictitious business name, or a trade name. It’s the name of the business that is presented to the public but is different from the company’s legal name.