How To Find and Hire a Tax Advisor

Find and hire the ideal tax advisor to manage complex tax obligations, maximize your finances, and ensure a legal, effective tax strategy.

September 17, 2024

September 17, 2024 9 minute reading

9 minute reading

Tax season looms, and you're drowning in a sea of forms and regulations. Your heart races as you wonder if you're making costly mistakes. Sound familiar?

You're not alone. As tax laws grow more complex, many turn to professionals for help. Whether you're a small business owner or freelancer or have complex finances, a tax advisor can be your financial lifeline.

But how do you find the right expert? Someone who'll navigate the tax maze, uncover opportunities, and safeguard your hard-earned money?

This guide will walk you through finding and hiring the perfect tax advisor.

Signs you need a tax advisor

As your financial situation becomes more complex, tax help becomes increasingly valuable. Consider delegating to a freelance tax advisor if:

You have multiple income sources (e.g., salary, freelance work, investments, rentals)

Your filing status changes due to marriage or divorce

You've had past tax issues or audits

You lack time or expertise to navigate complex tax laws

While their services come at a cost, the potential savings and peace of mind often make professional tax help a valuable investment.

Tax advisor vs. CPA

When it comes to managing your finances and taxes, two key professionals often come into play: tax advisors and Certified Public Accountants (CPAs). While their roles may overlap in some areas, they serve distinct purposes.

Tax advisors specialize in tax law and planning. They focus on:

Informing clients about tax-saving strategies

Identifying applicable deductions and credits

Developing targeted tax plans

CPAs offer a broader range of services that extend beyond tax preparation. They are certified experts who can handle:

Accounting and bookkeeping

Financial auditing

Comprehensive financial planning

Tax return preparation and filing

A CPA will represent you before the IRS. They are good for businesses, high-net-worth individuals, and anyone dealing with complex financial situations or IRS disputes.

In short, while tax advisors excel in creating targeted tax strategies, CPAs provide a more holistic approach to financial management.

How to hire a tax advisor

Learning how to hire a tax advisor starts with identifying your financial needs and researching qualified professionals. Here are the steps to take:

1. Find qualified tax advisors

There are three main ways to find a qualified tax advisor.

Online platforms

Local accounting firms

Referrals

Online platforms

Online platforms simplify the process of hiring external consultants. These platforms connect you with experienced tax advisors for both one-time consultations and ongoing support.

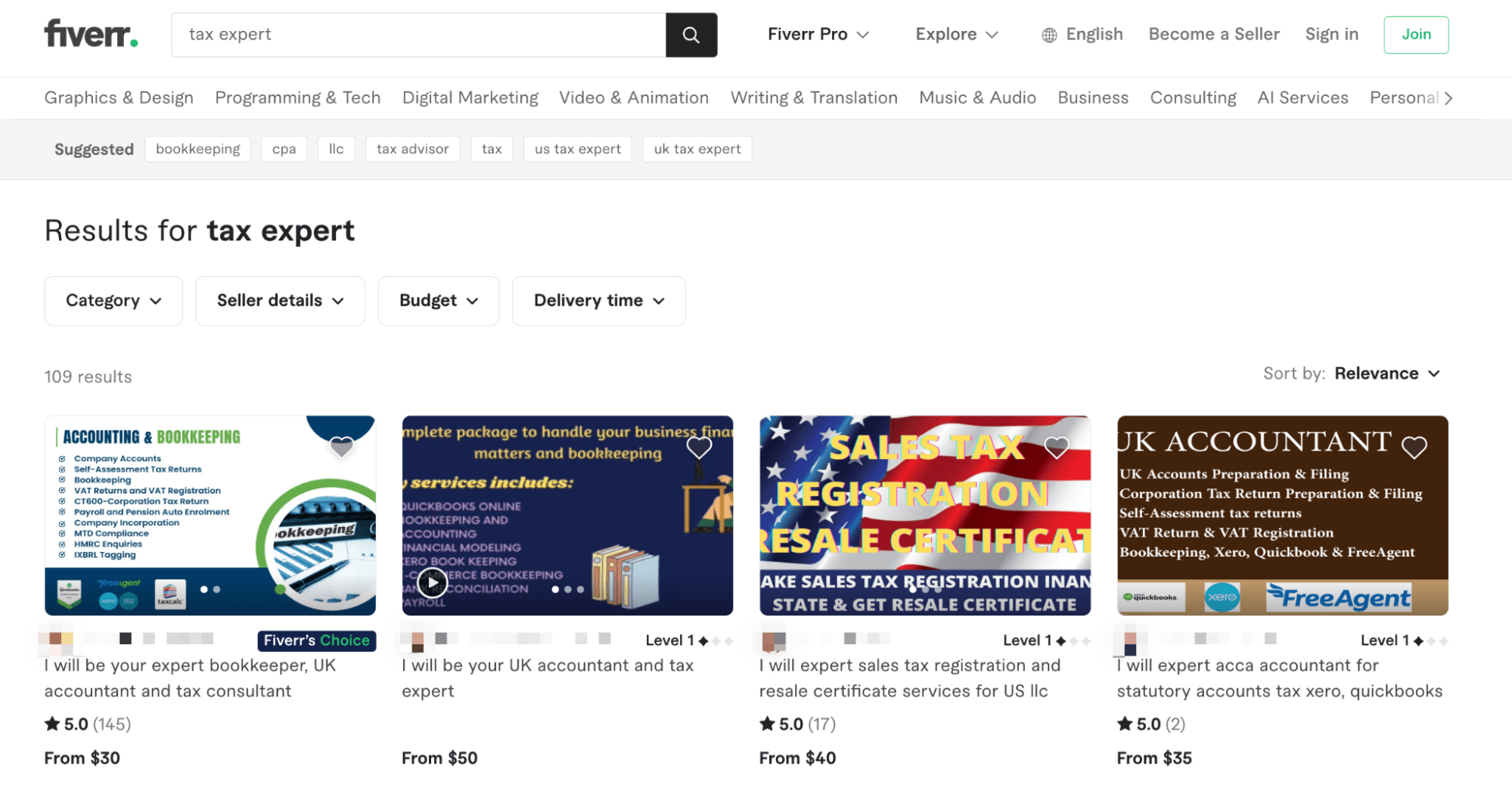

Fiverr gives you the ability to find a tax expert in several ways:

Search and browse

Use the search bar at the top of the Fiverr homepage to type in keywords like "tax expert" or more specific terms like "tax preparation" or "business tax consultation."

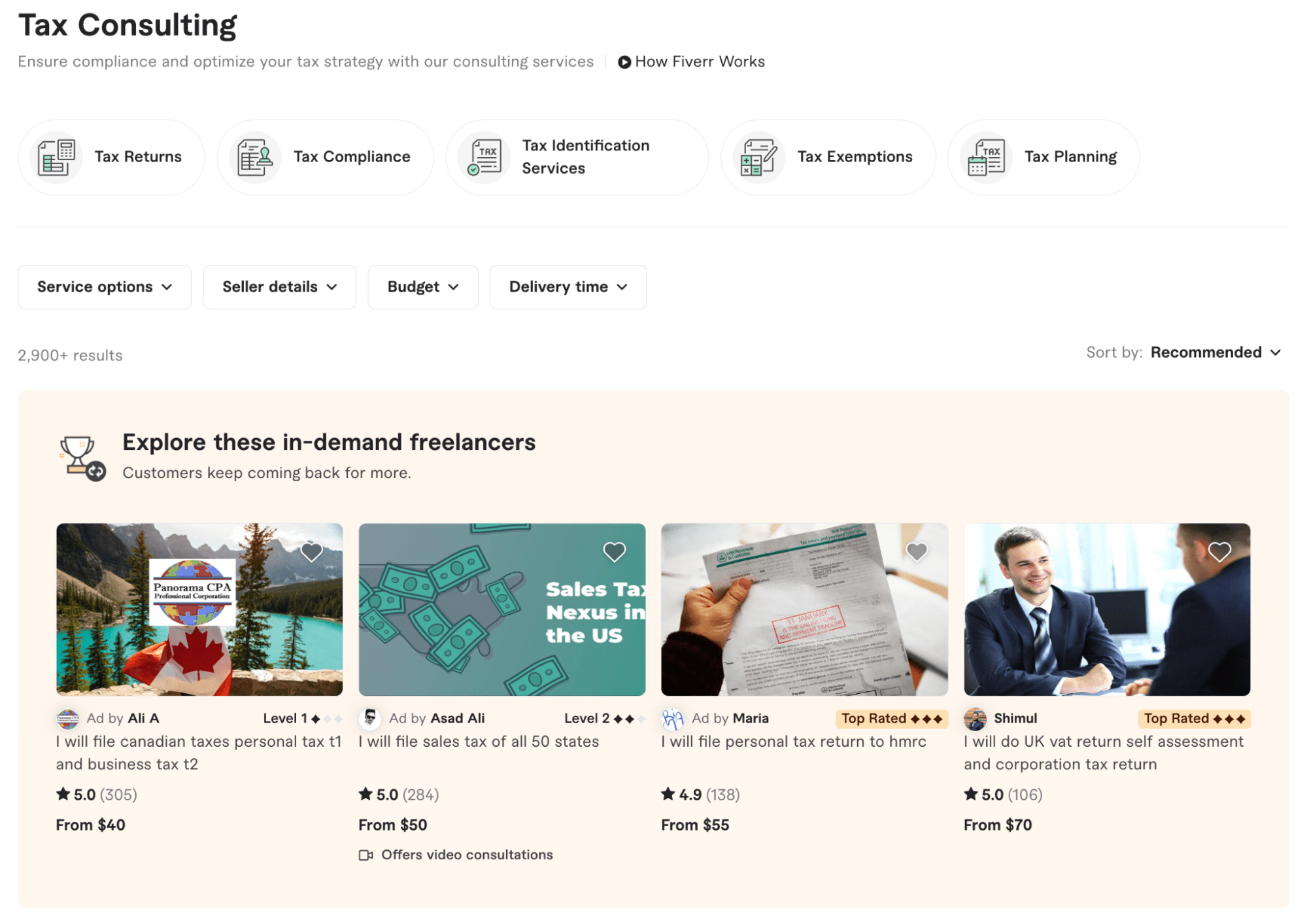

Or, you can browse through categories such as "Business" and then drill down to subcategories like "Tax Consulting."

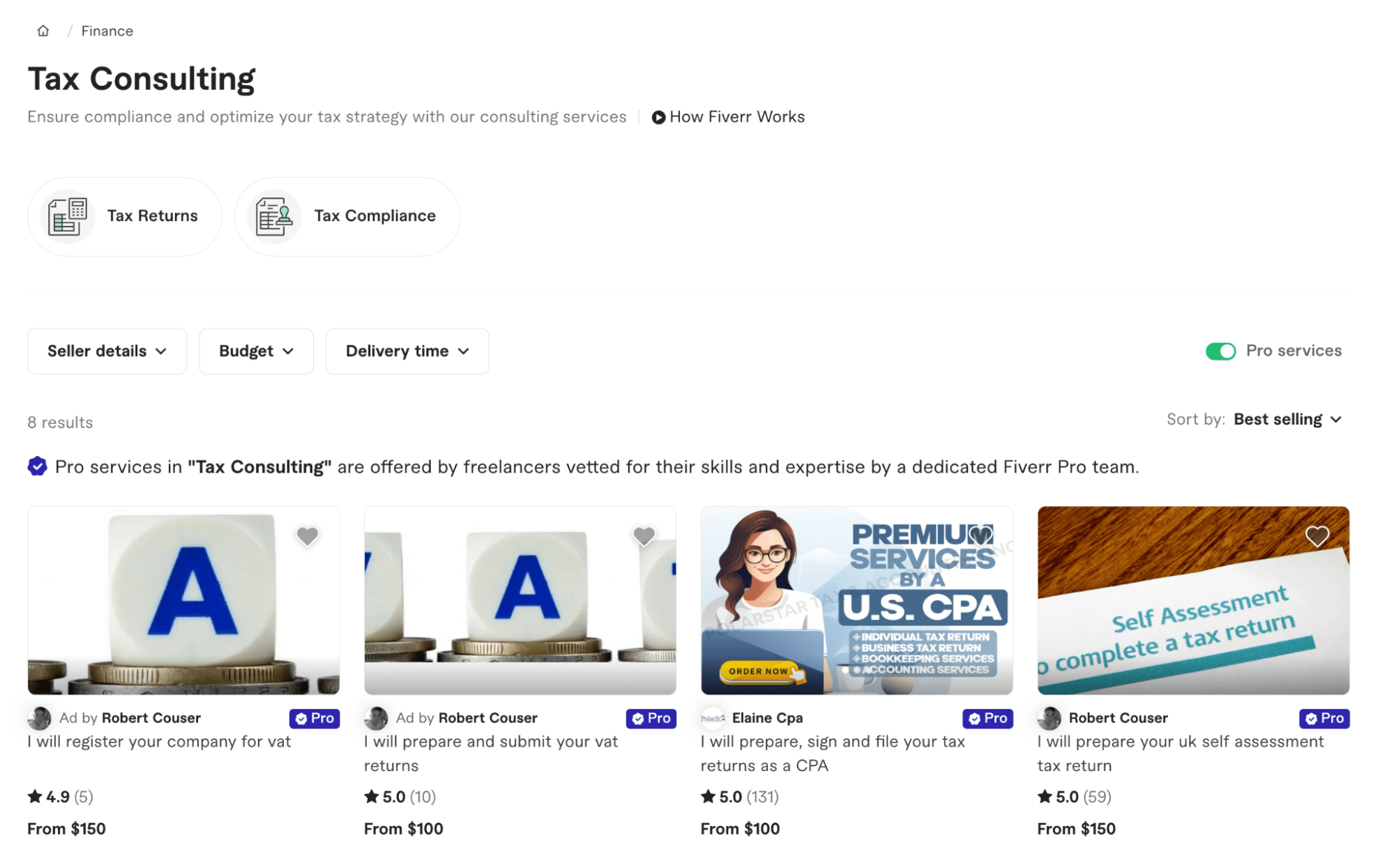

Then, toggle on “Pro services” to find highly-vetted tax professionals for more complex or premium tax-related tasks.

💡Tip: Refine your search results using filters such as seller level, location, budget, and delivery time to find the right tax expert.

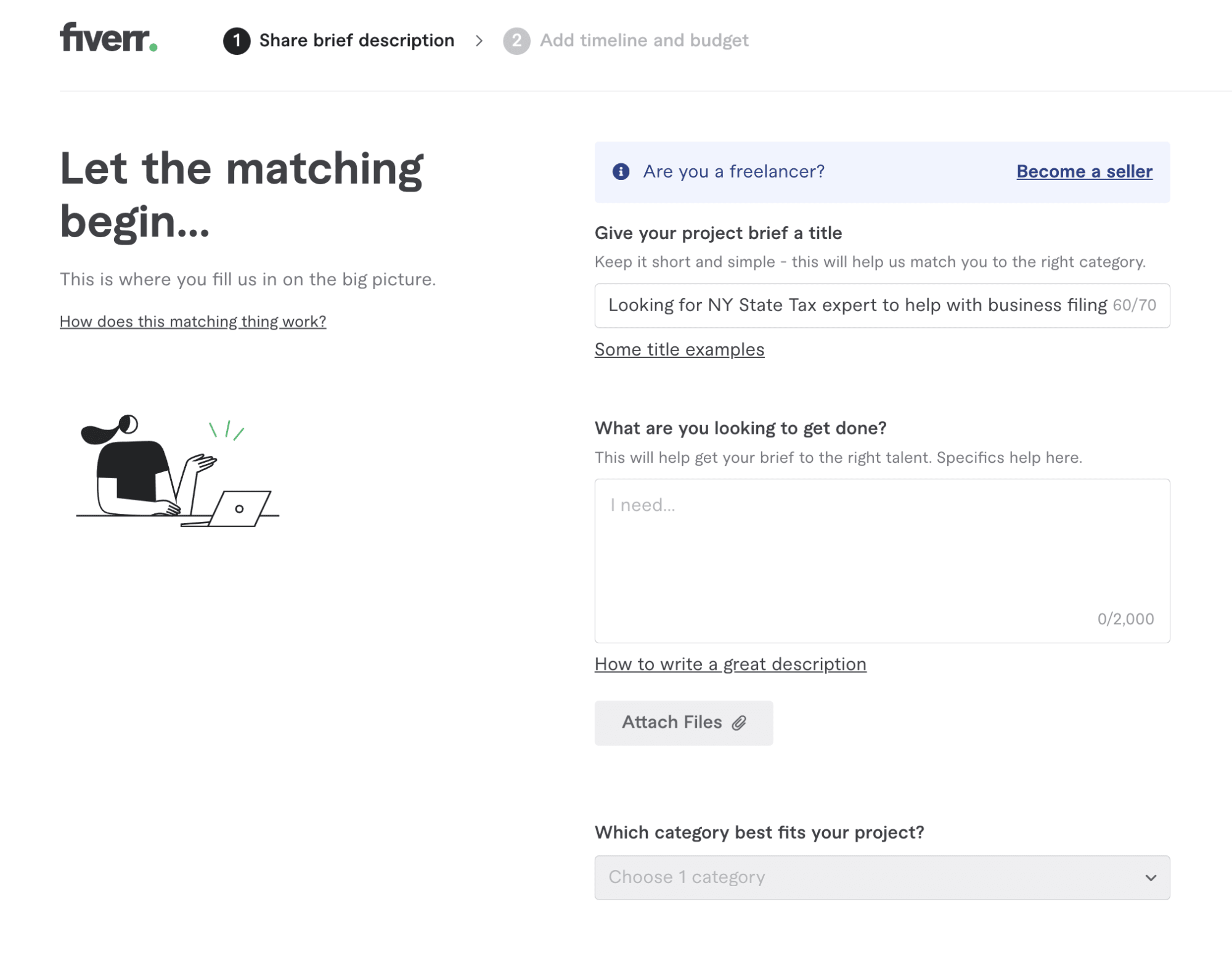

Post a request

Post a brief outlining the specific tax services you need. Sellers who offer relevant services can then respond with custom offers. This is ideal if you have specific requirements and want tax advisors to come to you with tailored proposals.

Neo, Fiverr AI agent

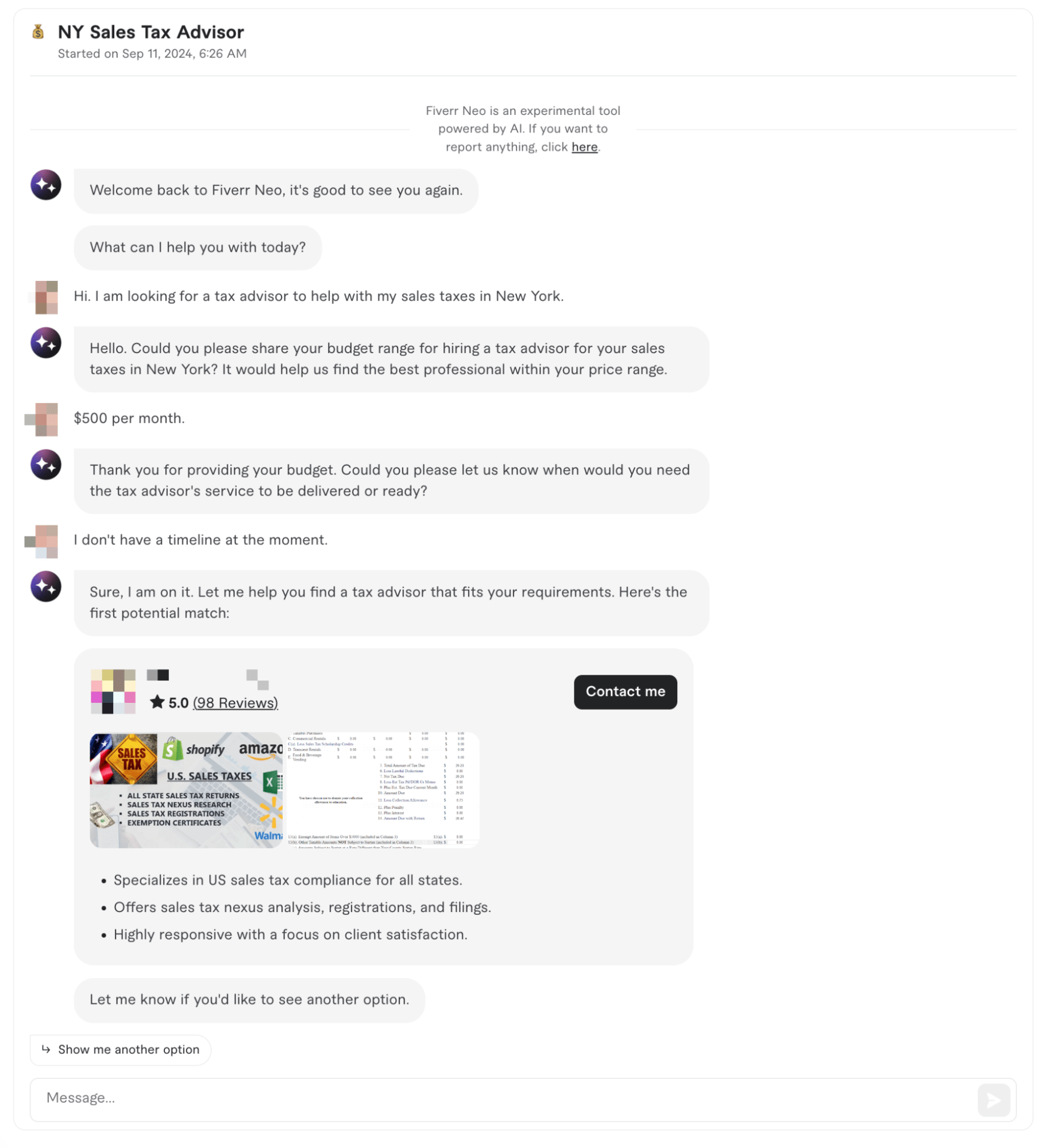

Fiverr’s Neo is an AI agent designed to help you find ideal freelancers for your specific projects.

It works by starting a conversation with you to understand your unique needs, asking follow-up questions to gather additional information, and then recommending the most suitable freelancer or presenting a list of qualified options based on your requirements.

If you’re looking for a Tax advisor to help with your sales tax in New York, for example, Neo can find you the best fit.

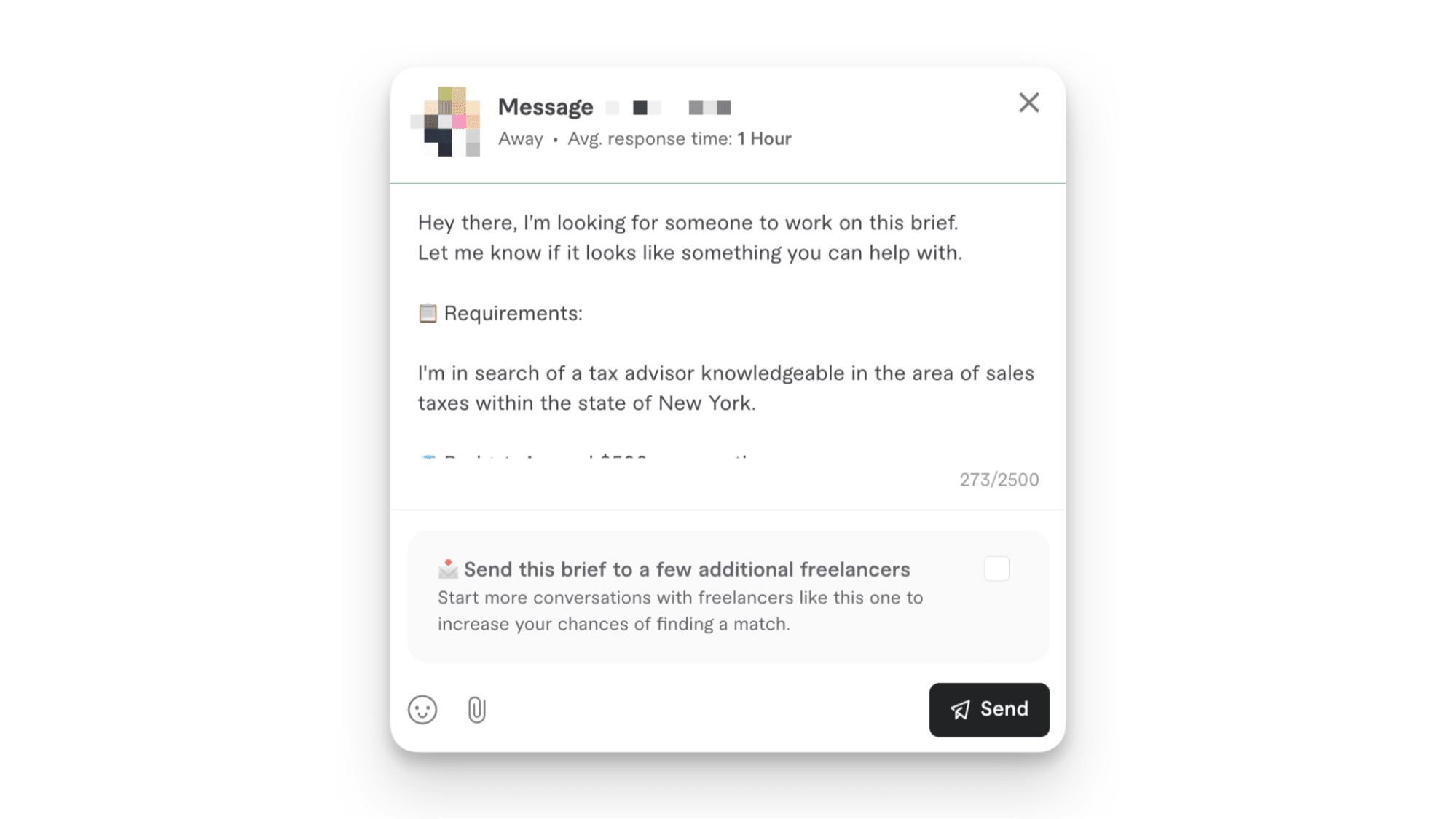

If you like the recommendation, simply click the “Contact me” button, and Neo will generate a message to send to the tax advisor.

Local accounting firms

Local accounting firms are valuable resources when seeking a tax advisor. These firms often provide various financial services and possess in-depth knowledge of local tax laws.

Choosing a local accountant can offer several advantages:

Personalized service tailored to your specific needs

Easier face-to-face meetings

Potential for building a strong, long-term working relationship

Clear communication due to shared local context

Referrals

Don't underestimate the power of word-of-mouth recommendations. Ask friends, family, and business contacts for referrals to trustworthy tax advisors. Personal recommendations often lead to advisors with proven track records of knowledge and reliability.

Find an Expert Tax Consultant for Hire

2. Look for the right qualifications

When seeking professional tax advice, it's crucial to find an accredited advisor who can best serve your needs. Look for recognized qualifications such as:

Enrolled Agents (EAs)

Certified Public Accountants (CPAs)

Tax Attorneys

These credentials demonstrate a high level of knowledge and adherence to professional standards.

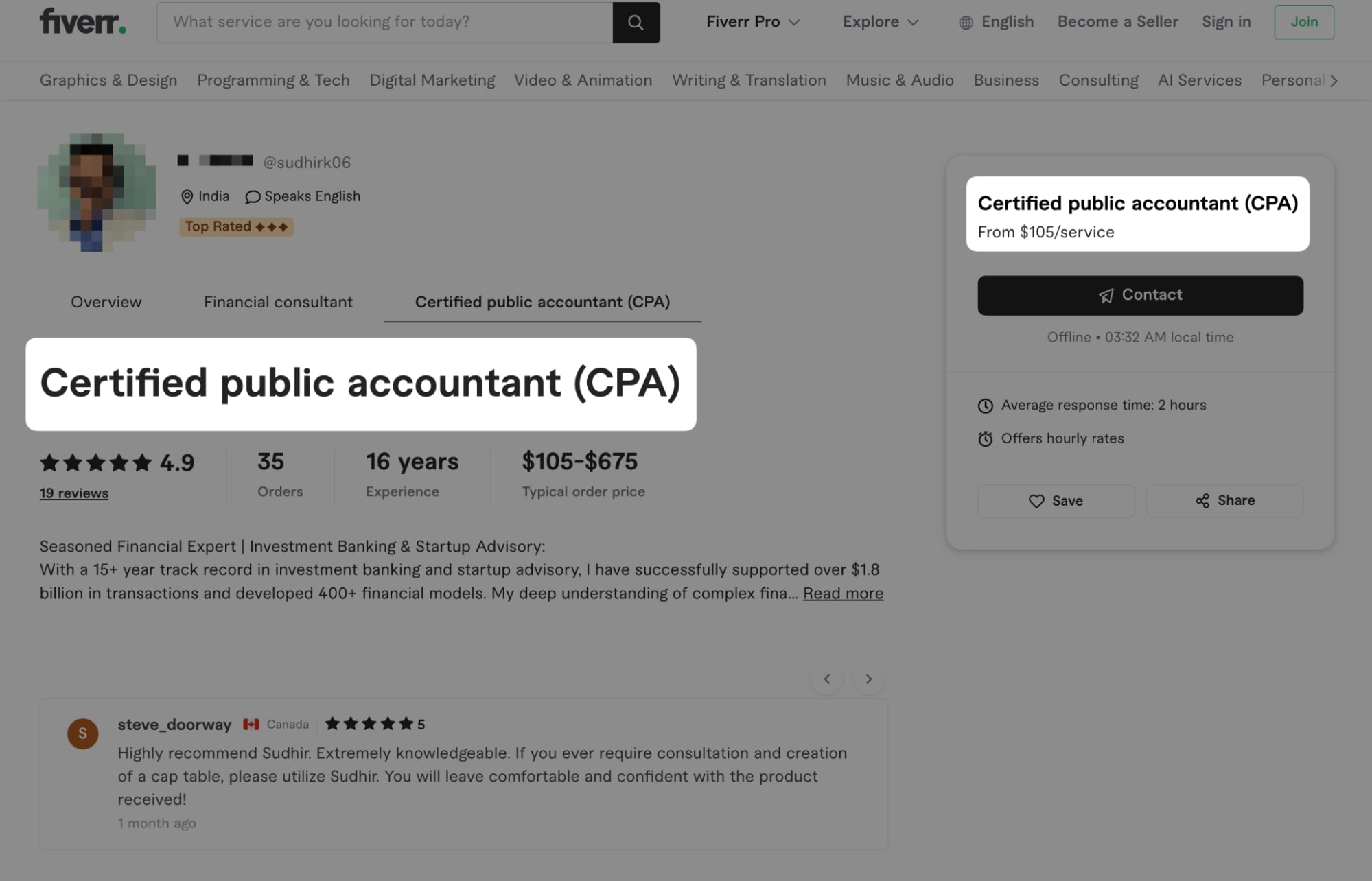

Consider the advisor's specializations and expertise. Fiverr's detailed seller profiles and service descriptions help you identify professionals with experience that matches your specific needs, whether it's small business taxation, real estate, or international tax law. You can quickly ensure their area of focus aligns with your financial situation.

Experience is another vital factor. Advisors with more years of practice often have:

Deeper understanding of complex tax issues

Practical problem-solving skills

Familiarity with a wide range of tax scenarios

Verify that the advisor stays current with tax laws through continuing education. The tax code changes frequently, so working with someone who regularly updates their knowledge is essential.

By leveraging Fiverr's platform, you can efficiently search, compare, and connect with qualified tax professionals who meet your specific requirements, saving you time and ensuring you find the right expertise for your tax needs.

3. Be prepared with questions

You have to ask the right questions to find the best tax advisor for your needs. The following questions will help you determine if a tax advisor ‘s is qualified.

What are your qualifications and specializations? Verify CPA or EA license and expertise in relevant areas like small business or foreign taxes.

How many years of experience do you have? More experience often indicates better adaptability and a broader knowledge base.

What types of clients do you typically work with? Find out what kind of clients they work with to determine their experience. For small businesses, it's helpful if they work with others like you.

How do you stay updated on changes in tax law? Ask how they stay current, such as attending seminars, classes, or professional groups.

What's your approach to tax planning and preparation? This question helps you understand how they work and if they suit you. Some advisors provide year-round advice, while others only file taxes.

How do you handle audits or IRS inquiries? Assess their audit experience and level of support provided.

What's your fee structure? Clarify pricing to avoid surprises and ensure it fits your budget.

How do you ensure client confidentiality? Inquire about security measures for protecting sensitive information.

Can you provide references? References reveal a person's reliability, communication, and work quality.

What's your availability and preferred communication method? Clear communication with your tax advisor is crucial, especially during tax season. Knowing when they're available and how they prefer to communicate—by phone, email, or in person—can help you set expectations and ensure a smooth working relationship.

4. Compare and evaluate potential tax advisors

After researching tax advisors, compare and contrast them to decide. Here are some good methods:

Assess their responses to your questions: Check how each advisor answered your questions. Was their response confident, clear, and informative?

Their answers reveal their knowledge, communication skills, and suitability for your needs. On Fiverr, you can easily communicate with multiple advisors to assess their responses before deciding.

Check references and online reviews: People's reviews and references can reveal an advisor's reliability and expertise. Ask for their references and read online reviews to learn what others thought.

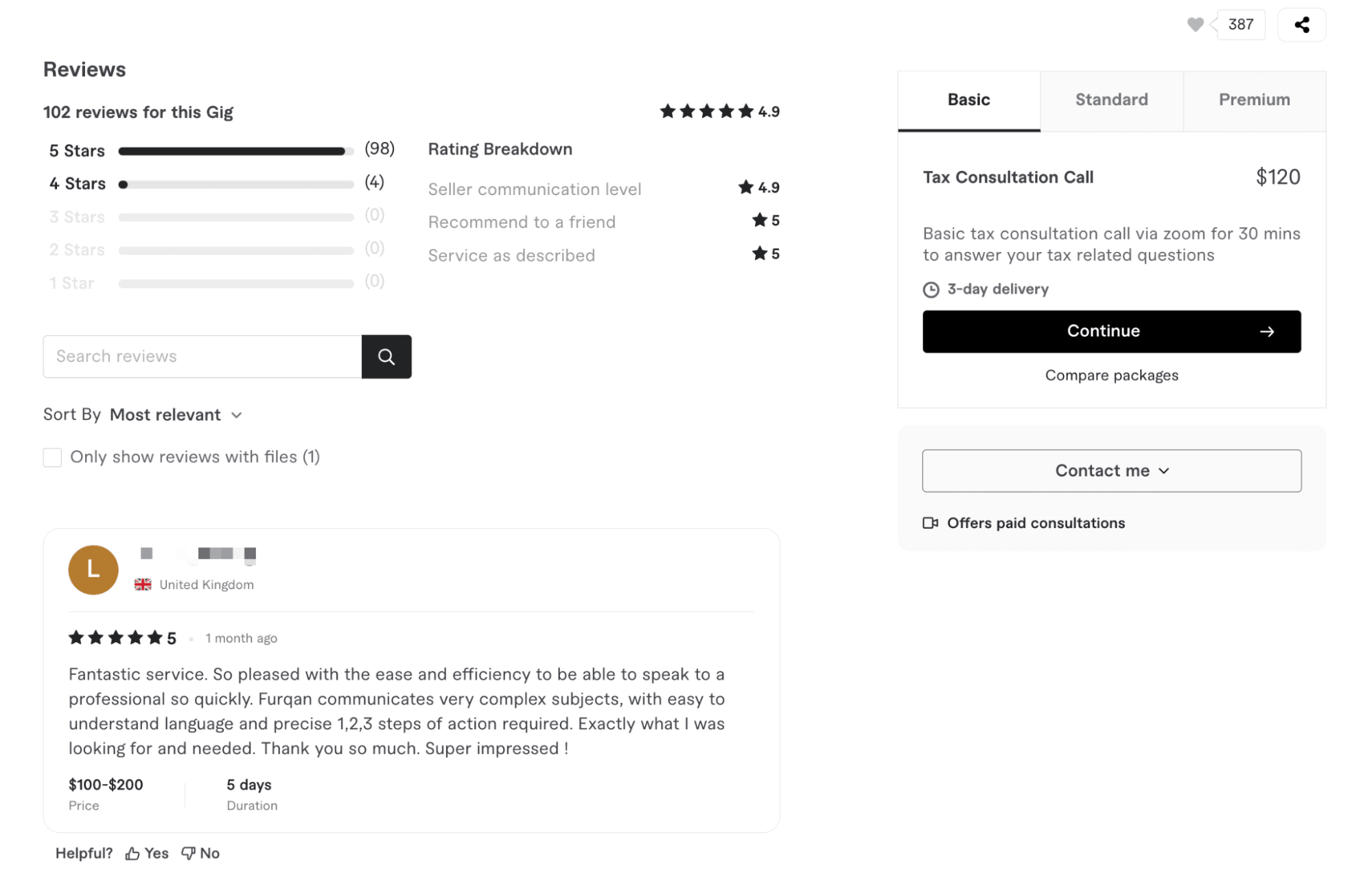

Fiverr gives you the ability to assess the quality of all the tax advisors by showing all the ratings and reviews, given to each, making it easy for you to view detailed feedback that help you make a better decision

CAPTION: Highly rated tax consultation service on Fiverr offering expert advice with top reviews and affordable pricing, starting at $120 for a 30-minute consultation.

Evaluate their communication style and professionalism: How an advisor communicates with you—both in terms of style and frequency—can greatly impact your working relationship.

Consider whether their communication style suits you. Do they respond quickly and professionally? Are taxes explained simply? These are crucial for a partnership.

Compare fees and services offered: Tax experts charge different rates and offer different services. Check their prices and services. Some offer all-inclusive packages, while others charge per task.

Fiverr makes this comparison easy by providing clear, upfront pricing and service descriptions for each advisor. You can quickly compare different packages and find one that fits your budget and needs.

Consider their expertise in your tax situation: Finally, choose a tax advisor with case-specific experience. A financial advisor who knows everything about small business taxes, investments, and international taxes can make a big difference.

Fiverr's search filters and detailed seller profiles can help you find advisors with expertise in your specific tax situation, whether it's personal, business, or international taxes.

5. Hire your tax professional

When selecting your tax advisor, balance your instincts with their qualifications. Look for someone who can meet both your current and future needs.

Before committing, review the engagement terms carefully, paying attention to services offered, fees, and confidentiality clauses. Establish clear expectations for communication and workflow from the start.

Fiverr makes it easy to find exactly what you need and hire the right tax advisor. To make the most of the process, we recommend to follow these tips:

Thoroughly examine service descriptions and reviews

Use the platform's messaging system to clarify any questions

Take advantage of Fiverr's protections, including payment holds and dispute resolution

Be specific about your requirements when placing an order

Keep in mind that complex tax situations often require ongoing, personalized attention that may extend beyond a single gig.

By thoughtfully considering these factors and leveraging platform safeguards, you can confidently choose a tax advisor and lay the groundwork for a fruitful professional relationship.

Why professional tax help is important

Tax laws are intricate and constantly evolving, making it challenging for individuals to stay informed and compliant. Even the most intelligent people often struggle to understand these changes, which is where tax experts shine.

Tax experts are skilled at identifying deductions and credits that you might overlook. Their expertise can help you:

Get the most money back on your tax return

Take advantage of all eligible deductions

Guarantee you're claiming all applicable credits

Mistakes on your tax returns, even small ones, can have costly consequences. The Internal Revenue Service (IRS) may impose fines, disallow deductions, or even initiate an audit. Having a tax professional review your returns significantly reduces these risks.

Hire an accredited tax advisor on Fiverr today

Explore Fiverr's pool of qualified tax advisors and find the perfect professional to optimize your tax strategy today. Whether you need help with tax preparation, planning, or ongoing consultation, Fiverr connects you with experienced freelance tax experts who can address your specific needs.

Sign up for free on Fiverr to save yourself the hassle of finding and hiring a tax advisor.

Hire a tax advisor FAQ

Who is the best person to get tax advice from?

CPAs or EAs are ideal for most tax filing and planning needs. For complex situations like business ownership or large investments, consult a tax lawyer or specialized advisor.

How much does a tax advisor cost in the US?

Costs vary based on complexity and expertise. Simple tax prep averages $200-$500. Complex services like planning and audit support can range from $1,000 to $5,000+. Fiverr offers budget-friendly options.

Is a tax advisor the same as a CPA?

Not always. CPAs are licensed professionals who've passed exams and met education/experience requirements. They offer broader financial services. Tax advisors may specialize in tax law or planning without CPA credentials.

What is the difference between a tax advisor and a financial advisor?

Tax advisors focus on minimizing taxes and navigating tax laws. Financial advisors address overall financial health, including investments, retirement, and estate planning. Both can be valuable, but their primary focuses differ.

The author is not a certified tax advisor. Seek professional guidance if needed.