5 Successful Joint Venture Examples to Inspire Your Own in 2025

Interested in exploring joint venture opportunities? Discover the best joint venture examples with successful operations, and get inspiration to set up your own.

December 17, 2024

December 17, 2024 12 minute reading

12 minute reading

Remember when Crocs first launched as a boat shoe in 2002?

Despite a standing start, the brand soared in popularity, went public, and became ubiquitous summer footwear.

But Crocs’ tide went out just as fast. Sales plummeted, shares fell to less than $1, and the company closed hundreds of distribution centers. It was even listed among Time magazine’s 50 Worst Inventions.

Today, Crocs boasts sales of more than 100 million pairs each year, over $3 billion in annual sales, and newfound fashion respect.

How did the company return to profit? Part of its success is attributed to hiring the right team. But it was Crocs’ deft and strategic joint ventures that elevated the brand in consumers’ minds.

Curious about the latter? This guide shares successful joint venture examples to inspire your own, plus tips to help you get started.

Find a Business Plan Expert for Hire

What is a joint venture?

A joint venture is a mutual business arrangement or relationship where at least two people or entities work together to meet a business objective and benefit financially.

A typical joint venture exhibits the following features:

A special partnership without a firm name (if co-venturers create a new entity, it will have a firm name)

A specific purpose, goal, or objective

A signed agreement to form the joint venture

A cash-basis accounting method

Co-venturers maintain accounts based on the agreement

Profit or loss is computed on completion of the venture and shared in an agreed proportion

A joint venture is formed for a limited time. However, partnering brands craft a strategy and pool resources to:

Create a new entity

Share expertise

Accomplish a particular goal or objective

“The last joint venture we entered into was an event to promote our business,” says Michael Nova, founder of Rise Up Eight. “We worked with several other businesses to co-promote the event and gained a 75% increase in attendance over the previous event, where we were doing it ourselves. By combining efforts with another company or several other companies, you can double or triple your results. It’s just a question of reaching more people and reaching a larger audience.”

Green Cola and Chitos—both beverage businesses—entered a joint venture to create Green Beverages Group to grow internationally and become a better-for-you market leader.

Source: Green Beverages

Green Beverages Group leverages Chitos Group’s strong heritage, Green Cola’s innovative, disruptive approach, and growing demand for natural/healthier beverages to strengthen both brands’ positions in their existing markets. Plus, it looks to launch in Australia, Asia, South America, and other new territories.

So far, the joint venture has helped the brands:

Develop expertise to accelerate global growth

Directly access international investment funds

Increase scale and reach

Maximize global growth opportunities

Build on their worldwide presence

Joint ventures also help brands spur innovation, reduce risks and costs, and achieve objectives either partner couldn’t do on its own.

Volkswagen joined with Enel, investing $105.38 million each to build 3,000 high-speed charging points for electric vehicles across Italy. By 2025, drivers of cars made by both manufacturers will have access to 45,000 fast-charging points across Europe, the US, China, and other stations around the world—something neither company could have done individually within the set timeline.

Types of joint ventures

Joint ventures are distinguished based on the parties’ goals and objectives. The most common types are:

Project-based: Both entities partner with a specific goal to execute a project or develop a service to offer their target market. The partnership ends when the project is over and completed. The University of Vermont entered a joint venture with Snyder-Braverman to create housing for its faculty, staff, and graduate students by 2026.

Functional-based: Two entities pair up for mutual benefit and better performance based on the synergy of their functional expertise. For example, one company may have trademarked patents and formulas but lacks funding to go to market, while the other company has the funds and commercial success but lacks in-house patents. Together, they complement each other and mutually benefit from the joint venture.

Vertical: Two entities co-existing in the same supply chain pair up to achieve their business goals and benefit their customers. For example, Coca-Cola entered a vertical joint venture with San Miguel Corporation and acquired full ownership of Coca-Cola Bottlers Philippines (CCBPI).

Horizontal: Here, direct competitors—usually in the same line of business—come together to benefit from opportunities in the industry and equally share the gains. For example, BMW and Brilliance Auto Group formed BMW Brilliance to produce and sell BMW cars in China.

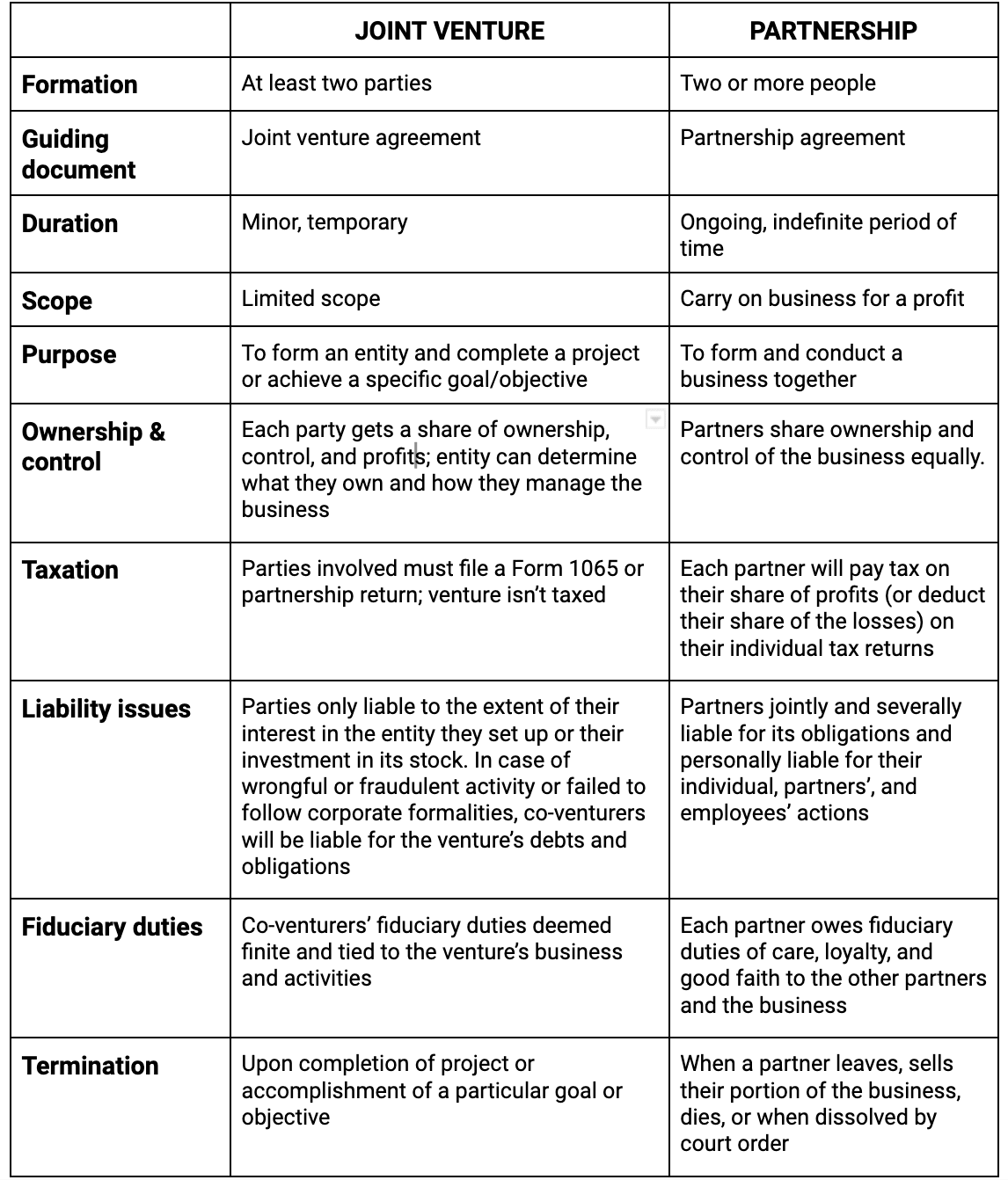

How Is a joint venture different from a partnership?

Joint ventures and partnerships may look similar, but they’re not. They differ in how, why, and for how long they’re formed. Let’s review what makes these entities different.

Source: Pexels

Formation

A joint venture is formed when at least two parties come together to mutually benefit from the pairing. It doesn’t necessarily result in forming a single business, but a separate entity can be created to accomplish a specific goal or objective for the short term. A partnership is established when two or more people enter into an agreement to form a single business and conduct profitable operations together for the long term.

Duration and scope

Joint ventures are usually minor and temporary with a more limited scope than a partnership. Joint ventures are set up for a single or series of transactions, running long enough to allow the parties reach a specific goal or task. Partnerships are ongoing and can last for an indefinite period of time, growing to an enormous size.

Purpose

A joint venture is established to complete a task, create a product for a specific purpose, or work on a particular project. Once completed, the joint venture typically ends. Partnerships are set up by people who wish to combine their skills and knowledge and work toward developing something over and for the long-term. The partners agree to conduct business together and share the profits and losses.

Ownership and control

In a joint venture, each party gets a share of ownership, control, and profits based on the joint venture agreement. If the parties start a new entity to run the venture, the entity can determine what they own and how they manage the business. In a partnership, the partners share ownership and control of the business equally. Each owner’s duties and ownership share are usually outlined in the partnership agreement.

Taxation

The Internal Revenue Service (IRS) defines a joint venture as a legal partnership, which means the parties involved must file a Form 1065 or partnership return. The venture isn’t taxed but each party has to report their income from the venture and file personal taxes separately.

Partnerships are pass-through tax entities meaning all profits and losses pass through the business to the partners. That means each partner will pay tax on their share of profits (or deduct their share of the losses) on their individual tax returns.

Liability issues

In a joint venture, each party will only be liable for its obligations to the extent of their interest in the entity they set up or their investment in its stock. In cases where the venture is engaged in wrongful or fraudulent activity or failed to follow corporate formalities, its co-venturers will be liable for the venture’s debts and obligations.

In a partnership, the partners are jointly and severally liable for its obligations and personally liable for their individual, partners’, and employees’ actions.

Fiduciary duties

In a joint venture, the members’ fiduciary duties are deemed finite and tied to the venture’s business and activities. In a partnership, each partner owes fiduciary duties of care, loyalty, and good faith to the other partners and the business.

Termination

A joint venture ends when the project is completed, when it accomplishes the specific goal or objective for which it was formed, or when there’s a relationship breakdown between the partners. While a partnership is ongoing, it can end when a partner leaves, sells their portion of the business, or dies, or when dissolved by court order.

Here’s a summary of the differences between a joint venture and a partnership:

Advantages and disadvantages of joint ventures

Advantages

Whether you want to promote your business, diversify your offerings, or enter a new market, joint ventures can be a great strategic opportunity. Here are the key benefits of using one for your project or goal:

Shared investment, expertise, expenses, and risks

New market penetration and revenue streams

Increased market share and rate of success

Increased innovation from shared expertise and resources

No long-term commitment required

Enhanced credibility for both parties

Improved economies of scale and reach

Added diversity of products and services

Reduced risk should it not deliver expected returns

Disadvantages

Despite all its merits, a joint venture has certain risks and drawbacks:

It requires significant financial investment

There’s potential for revenue decline

An improperly drafted agreement may expose co-venturers to legal risks

The rush to completion can overwhelm co-venturers

It lacks leadership continuity

Cultural mismatches or different management styles threaten its success

Unequal or declining executive input throughout the process hampers progress

Co-venturers may lack forethought and discipline to respond to changes in risk

Managers can call it quits before creating real value

Irreconcilable differences and bitter disputes can emerge and erupt

Real-world joint venture examples

The best business pairings deliver big results. Here are five joint venture examples you can learn from to inspire your own.

1. Nestlé + PAI Partners

Source: Pixabay

Nestlé set up a joint venture with PAI Partners—a Buitoni pizza maker—to establish a business and house its European frozen pizza.

Nestlé retains its non-controlling stake, with equal voting rights alongside PAI Partners, whose pizzas are distributed in countries such as Spain, Germany, France, and Switzerland. Plus, the company will participate in preparing the venture for future growth and value creation while providing the best pizza for its consumers and retail partners.

The joint venture business entity will be headquartered in Germany and operate two manufacturing facilities in Germany and Italy.

Nestlé hopes to benefit from PAI’s platform to develop the joint venture’s full potential and share deep expertise in creating leading food and consumer goods.

2. Frasers Group Asia + PT MAP Active

Source: Pexels

Frasers Group Asia—a subsidiary of Frasers Group—and retail giant PT MAP Active entered a joint venture to take UK activewear brand Sports Direct to Indonesia.

The venture is part of Frasers Group’s international expansion strategy, which includes rolling out its owned brands—which include Slazenger, Everlast, and Firetrap—at Sports Direct stores across Indonesia. Through this market, the company seeks to highlight its brands and build the best multi-sport destination.

PT MAP Active, which also distributes Foot Locker sneakers, apparel, and accessories, also hopes to further grow its presence in SouthEast Asia.

Through their Sports Starts Here mission statement, the sports brands will deliver best-in-class product range, value, and experience. The Sports Direct stores will feature dynamic sports equipment across categories including running, football, rackets, training, leisure, and outdoor.

3. Architecture: Shannon Abloh + Nike

Nike partnered with Shannon Abloh, CEO of Virgil Abloh Securities, to create a joint venture called Architecture.

Through this venture, Nike hopes to continue the late Virgil Abloh’s creative work of luxury streetwear. Nike will also sell Off-White products, including the Off-White Nike Terra Forma, which Abloh designed from scratch for the brand, and some apparel.

4. Virgin Atlantic + SkyTeam Alliance

Source: Virgin Atlantic

Virgin Atlantic joined SkyTeam as the newest member of the global airline alliance and the only UK member airline.

Through this joint venture, SkyTeam seeks to enhance the alliance’s transatlantic network and services so its customers can benefit from a consistent, seamless experience to and from London Heathrow and Manchester Airport. Besides accessing a network of 760 airport lounges across six continents, customers will also get opportunities to earn and redeem points across member airlines.

Virgin Atlantic Flying Club members also get global loyalty benefits. Its Silver Card holders get SkyTeam Elite membership recognition, while Gold Card members get Elite Plus membership status, along with other benefits like priority check in, baggage handling and boarding.

Virgin Red members get to connect their accounts and use their Virgin Points to travel further.

The venture will benefit both brands through their shared customer-first ethos, established relationships with other valued partners, synergies and expanded network, and loyalty offerings.

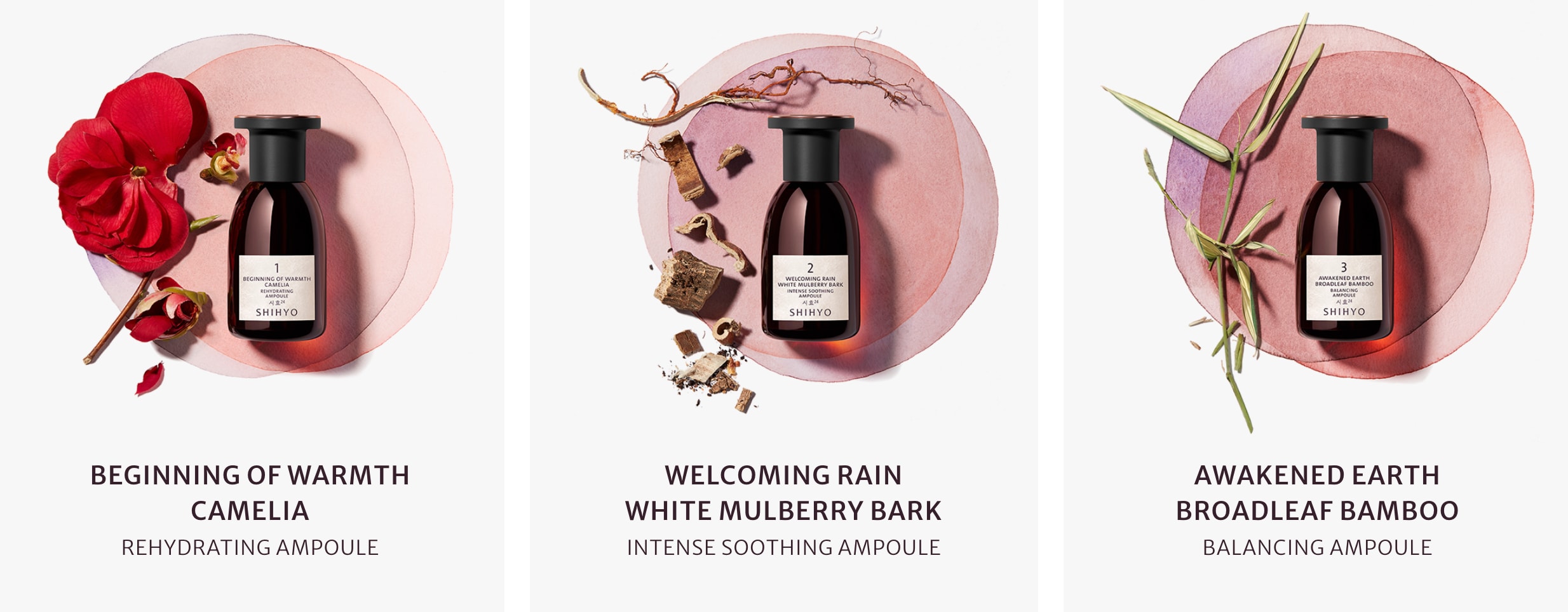

5. Shihyo: L’Oréal + Hotel Shilla + Anchor Equity Partners

Source: Shihyo

L’Oréal joined forces with Hotel Shilla and Anchor Equity Partners to co-invest and launch Shihyo—a luxury beauty brand.

The Loshian third-party joint venture marries together the three brands’ rich expertise—L’Oréal’s beauty expertise, Shilla’s luxury retail channel, and Anchor’s robust financial business model—to elevate the desire for natural, luxury beauty in Asia. Each company owns close to an equal share of the investment.

The Shihyo lineup includes 24 ampoules with Korean herbal ingredients sourced directly from local farmers and leveraging the Korean innovation ecosystem.

Tips for a successful joint venture

To help you set up a joint venture, we reached out to a few entrepreneurs for some key tips and tricks you can apply to ensure the smoothest transition possible.

“Lay out ahead of time what responsibilities each party has in the joint venture," says Michael Nova. “If everything is laid out ahead of time, preferably in writing, then it is clear who is responsible for what, and this actually creates a better and easier workflow for everyone, and everyone ends with more targeted, more successful results. Make sure the business plan is a win-win situation for both parties.”

“Have contracts in place and regularly review expectations,” says Lexie Smith, founder and CEO of THEPRBAR Agency.“Always treat each other with respect and kindness, and be prepared to compromise at times, leaving your ego at the door.”

“Do your due diligence and market research on the potential partner’s reputation, financial stability and market position, and your business’s compatibility with them,” says Matt Little, co-owner at Damien McEvoy Plumbing.

“Establish clear communication channels with all parties involved throughout the duration of the agreement to minimize misunderstandings that could lead to disputes,” says Ilia Mundut, founder and CEO of Heftyberry.“Ultimately success depends on careful planning combined with an open-minded approach towards mutual cooperation.”

Build a successful alliance

With the right partners, a joint venture can expand your business opportunities and create wealth.

Struggling to decide whether a joint venture is right for you? Hire one of Fiverr’s expert business consultants to review your existing collaborations and advise on new ones you should seek out.

Fiverr—a leading digital services marketplace—offers access to freelance experts in various fields relevant to joint venture operations, such as market research, financial analysis, legal services, and marketing strategies.

Through our chat system, you can communicate about your project with freelancers before hiring to ensure alignment. And, you can manage and track freelancers, project files, progress, and payments in a single dashboard—all at no cost.

Sign up to Fiverr today to find joint venture experts for your next project.